To be clear, Americans were the unusual ones here, not Asians. Canada had Seagram and J.D. Irving, Netherlands had Unilever, Switzerland had Nestle - I could keep going for a while. Opening up US capital markets meant Americans were rather small fish in a large pond. I'm actually not entirely sure how it worked out as well as it did. If you look at the ultimate beneficial owners of a lot of American brands, I suppose you could argue that it didn't.

Yes.

Protectionism is an umbrella term, and a loaded one at that - protectionism comprehensively accounts for everything you can do about anticompetitive foreign firms other than a race to the bottom (which is what the US ended up doing).

Basically,

It's protectionism, but calling it protectionism is honestly too grand. It's Big Crybaby Trump taking his ball and going home. There's no deeper thought at work here, or honest attempt to contain an ideological foe. It's about rolling back the clock to the 1950s and 1960s when the US had access to a global market and had no competitors.

The US is the largest market for English-language goods, and, well, pretty much everything else. It's a great market full of great customers, and people want to sell there. That's about it, though. If the US takes access to American customers off the table, the discussion is over because the US sure isn't offering anything else.

China's domestic market is incredibly restrictive, which isn't good, but at least they're offering some kind of value.

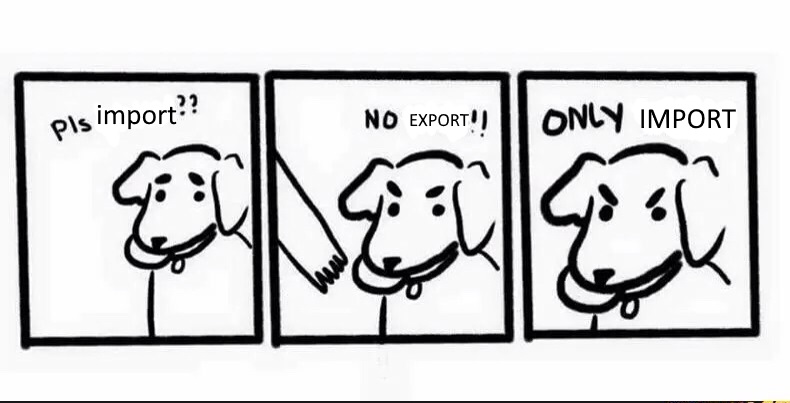

Thinky bits were all made in California, and the rest was relatively straightforward. I'm not sure it would have limited things too much, at least on the supply side. Demand side would have stung more. I know if I ran a country in the 1970s and the US said "no export, only import" about computers, I would have done almost anything to block US access to my market and build my own.

Supply side would be a bigger issue today: computer PCBs and semiconductor fabs use crazy amounts of incredibly toxic chemicals. EPA crackdown is why Intel moved their fabs overseas, for example. The whole Bay Area is a superfund site because of Intel and Fairchild dumping those chemicals. Intel might have to use cleaner, more expensive processes if trade barriers keep going up.

Nope, moat is economic rent. I meant it the same way Thiel and Buffet did. The only way you can survive today is if you are the beneficiary of some market barrier that prevents titanic conglomerates from crushing you with money and manpower. Individual creative achievement and hours logged are not enough. Copyrights and patents sometimes are, but just barely. The sweet spot is winning the network effect lottery, but that's only good enough to get you bought out.

****'s baaaaad. This is why almost nobody's starting businesses in the US anymore.

Amazon isn't even really a conglomerate yet.