^ this is what I've been taking about any time in the past years I've said "NAFTA is a bad deal for Canada". It's not because free trade with the US is bad. It's because NAFTA only exists to benefit the US.

Inauguration Day, Inauguration Hooooooraaay!

2017-04-29, 4:40 PM #1641

Jon`C

Admiral of Awesome

Posts: 18,626

2017-04-29, 5:59 PM #1642

Reverend Jones

Registered User

Posts: 9,096

That's all pretty shameful. Thanks for educating this American on his own government's bad behaviour.

This is kind of a BS analogy I am about to make, but.... in other news, according to this guy, Google and SV VC's don't know what to do with all their cash, and apparently want to be the dairy producers of cloud computing. Or something like that.

This is kind of a BS analogy I am about to make, but.... in other news, according to this guy, Google and SV VC's don't know what to do with all their cash, and apparently want to be the dairy producers of cloud computing. Or something like that.

2017-04-29, 6:22 PM #1643

Reid

^^vv<><>BASTART

Posts: 9,114

There's not much of an end to the various ways in which the United States is a ****ty country. Just recently I read a thing about the Korean war. Turns out the Air Force so thoroughly bombed the North that there were literally no targets. So they bombed dams, a war crime, because simply not bombing was unacceptable.

Speaking of war crimes, it was common practice for U.S. soldiers to take no prisoners in the war against Japan. And not due to lack of genuine surrender, because after concerted efforts by command to cull the murders, the PoW:dead ratio rose from 1:100 to 1:7.

Speaking of war crimes, it was common practice for U.S. soldiers to take no prisoners in the war against Japan. And not due to lack of genuine surrender, because after concerted efforts by command to cull the murders, the PoW:dead ratio rose from 1:100 to 1:7.

2017-04-29, 6:30 PM #1644

Reid

^^vv<><>BASTART

Posts: 9,114

In the vein of broken promises, you also have like every treaty the U.S. ever signed with any of the native nations.

2017-04-29, 6:34 PM #1645

Reverend Jones

Registered User

Posts: 9,096

Quote:

lack of genuine surrender,

That's interesting, since the received wisdom here seems to be that the Japanese were both incredibly brutal / sadistic, and also were said to have been hiding out in the jungle and staging ambushes years and years after the war ended.

2017-04-29, 6:38 PM #1646

Reid

^^vv<><>BASTART

Posts: 9,114

Originally posted by Reverend Jones:

That's interesting, since the received wisdom here seems to be that the Japanese were both incredibly brutal / sadistic, and also were said to have been hiding out in the jungle and staging ambushes years and years after the war ended.

Welcome to wartime propaganda. The impression you stated isn't entirely false, it's just used to sweep U.S. crimes under the rug. It also helps that the Japanese will do everything they can to avoid the subject of war crimes.

2017-04-29, 6:39 PM #1647

Reverend Jones

Registered User

Posts: 9,096

N.B. to my post: (Not to imply that that excuses American war crimes!)

2017-04-29, 6:40 PM #1648

Reverend Jones

Registered User

Posts: 9,096

Originally posted by Reid:

Welcome to wartime propaganda. The impression you stated isn't entirely false, it's just used to sweep U.S. crimes under the rug. It also helps that the Japanese will do everything they can to avoid the subject of war crimes.

I am sure you are right.

2017-04-29, 7:29 PM #1649

ECHOMAN

"Has it won yet?"

Posts: 17,215

Originally posted by Jon`C:

Here's the true version that you haven't been told. The US dairy industry is crumbling apart right now due to a capitalist crisis (massive overproduction). The US wants access to the Canadian market so they can dump excess inventory and maybe limp along for another year before the entire US dairy industry collapses.

If the US decided to drone-strike the cows and crater the farms they were on, would that be, in a weird way, a solution to the overproduction issue (for some time)?

SnailIracing:n(500tpostshpereline)pants

-----------------------------@%

-----------------------------@%

2017-04-29, 8:03 PM #1650

Reverend Jones

Registered User

Posts: 9,096

That sounds... messy.

2017-04-29, 9:20 PM #1651

Jon`C

Admiral of Awesome

Posts: 18,626

Originally posted by ECHOMAN:

If the US decided to drone-strike the cows and crater the farms they were on, would that be, in a weird way, a solution to the overproduction issue (for some time)?

Look, dude, Montana is your problem. You can do whatever you want with it.

2017-04-29, 9:44 PM #1652

Reid

^^vv<><>BASTART

Posts: 9,114

U.S. wins decisive victory in the war on overproduced dairy. In other news, Raytheon sees record profits.

2017-04-30, 10:31 AM #1653

Jon`C

Admiral of Awesome

Posts: 18,626

https://www.vox.com/new-money/2017/4/29/15471634/american-airlines-raise

Alternative headline: Kevin Crissy, Jamie Baker add themselves to internet database of insufferable capitalists, bank on the coming revolution not happening until they are already dead.

Quote:

American Airlines agreed this week to do ... close a gap that had opened up between their compensation and the compensation paid by rival airlines Delta and United.

...

“This is frustrating. Labor is being paid first again,” wrote Citi analyst Kevin Crissey in a widely circulated note. “Shareholders get leftovers.”

...

JP Morgan’s Jamie Baker was even more scathing than Crissey.

"We are troubled by AAL's wealth transfer of nearly $1 billion to its labor groups,” he wrote, suggesting that the move was not just contestable as a matter of business strategy, but somehow obviously illegitimate.

...

“This is frustrating. Labor is being paid first again,” wrote Citi analyst Kevin Crissey in a widely circulated note. “Shareholders get leftovers.”

...

JP Morgan’s Jamie Baker was even more scathing than Crissey.

"We are troubled by AAL's wealth transfer of nearly $1 billion to its labor groups,” he wrote, suggesting that the move was not just contestable as a matter of business strategy, but somehow obviously illegitimate.

Alternative headline: Kevin Crissy, Jamie Baker add themselves to internet database of insufferable capitalists, bank on the coming revolution not happening until they are already dead.

2017-04-30, 10:43 AM #1654

Jon`C

Admiral of Awesome

Posts: 18,626

I'm always amazed any time I see anything from these Wall Street ****wits. As entitled as children and about as good at finance as children, too.

Repeat after me: US. Stocks. Do. Not. Trade. On. Fundamentals.

Repeat after me: US. Stocks. Do. Not. Trade. On. Fundamentals.

2017-04-30, 11:30 AM #1655

Reverend Jones

Registered User

Posts: 9,096

I feel like I now understand trickle down economics' promise to labor of rising wages when I look at it as a sort of magic trick. The only trick that magicians use to fool their audiences is getting them to look at the wrong places while they bamboozle them, and it works almost every time.

2017-04-30, 11:32 AM #1656

Reverend Jones

Registered User

Posts: 9,096

"Trick"le down economics.

2017-04-30, 11:35 AM #1657

Jon`C

Admiral of Awesome

Posts: 18,626

Common Wall Street "wisdom":

- Dividends are for unsophisticated investors.

- It's good when founders and executives keep majority control through special voting rights, dilutatory compensation, and stock repurchase.

- The money earned by a corporation belongs to the shareholders. Even though they don't have any access to it. Or way to direct its use. Or any legal right to get it back.

- Dividends are for unsophisticated investors.

- It's good when founders and executives keep majority control through special voting rights, dilutatory compensation, and stock repurchase.

- The money earned by a corporation belongs to the shareholders. Even though they don't have any access to it. Or way to direct its use. Or any legal right to get it back.

2017-04-30, 11:43 AM #1658

Reverend Jones

Registered User

Posts: 9,096

Speaking of childish behavior, I read the other day that Bloomberg terminals include a private Craigslist-like message board.

Apparently, the level of discourse there is said to be at sub-/b/ levels.

Apparently, the level of discourse there is said to be at sub-/b/ levels.

2017-04-30, 2:08 PM #1659

Reid

^^vv<><>BASTART

Posts: 9,114

Originally posted by Jon`C:

I'm always amazed any time I see anything from these Wall Street ****wits. As entitled as children and about as good at finance as children, too.

Repeat after me: US. Stocks. Do. Not. Trade. On. Fundamentals.

Repeat after me: US. Stocks. Do. Not. Trade. On. Fundamentals.

Well, yeah, ever since 2008 it's been pretty clear to me that the stock market is supremely oversaturated with capital, and isn't a vast majority of trading speculative?

2017-04-30, 2:09 PM #1660

Reid

^^vv<><>BASTART

Posts: 9,114

Originally posted by Reverend Jones:

I feel like I now understand trickle down economics' promise to labor of rising wages when I look at it as a sort of magic trick. The only trick that magicians use to fool their audiences is getting them to look at the wrong places while they bamboozle them, and it works almost every time.

Trickle down economics work. They get a lake, we get a trickle.

2017-04-30, 7:28 PM #1661

Jon`C

Admiral of Awesome

Posts: 18,626

Originally posted by Reid:

Trickle down economics work. They get a lake, we get a trickle.

Trickle down economics work. They slow economic growth down to a trickle.

2017-04-30, 8:05 PM #1662

Reverend Jones

Registered User

Posts: 9,096

Originally posted by Jon`C:

Trickle down economics work. They slow economic growth down to a trickle.

Well that's a funny thing. There's a right wing loud mouth on AM radio who likes to punctuate his daily tirades by raising the specter of the 'no growth eco-Marxists'.

But if it's actually capitalism itself slowing itself down while still depending on perpetual expansion for its continuing existence....

2017-04-30, 8:22 PM #1663

Reverend Jones

Registered User

Posts: 9,096

I am still waiting for the economic boom that we're gonna be getting any time now by bringing back our glorious coal mining jobs.

2017-04-30, 8:25 PM #1664

Jon`C

Admiral of Awesome

Posts: 18,626

Originally posted by Reverend Jones:

"if"But if it's actually capitalism itself slowing itself down while still depending on perpetual expansion for its continuing existence....

One of the pillars of trickle-down economics is a tax cut for the rich. The idea is that rich people will buy more capital (expand the economy) if they have excess money. Then they'll hire people to work that capital, spreading the money around to the poor.

The reason this doesn't work is because it's not rational to build a factory if you don't expect people to buy the products you make. It doesn't matter how much discretionary income they have. It's better to stay liquid and wait for a good opportunity than throw good money into a bad market.

Incidentally, the way you avoid this problem is through business taxes. Unlike you and me, businesses are taxed on their profits (revenues minus expenses - and before you say it, no, until you can deduct rent and food, your petty deductions aren't the same thing). A high corporate tax rate, even a punitively high one, means corporations "use it or lose it": they have a strong incentive to spend their money today, and expand the economy today, in anticipation of future bull markets - and, by that very expenditure, end the crisis.

Without that stick, rich people sit on stagnant cash forever, waiting for an upturn that will never come.

2017-04-30, 8:29 PM #1665

Jon`C

Admiral of Awesome

Posts: 18,626

Originally posted by Reverend Jones:

I am still waiting for the economic boom that we're gonna be getting any time now by bringing back our glorious coal mining jobs.

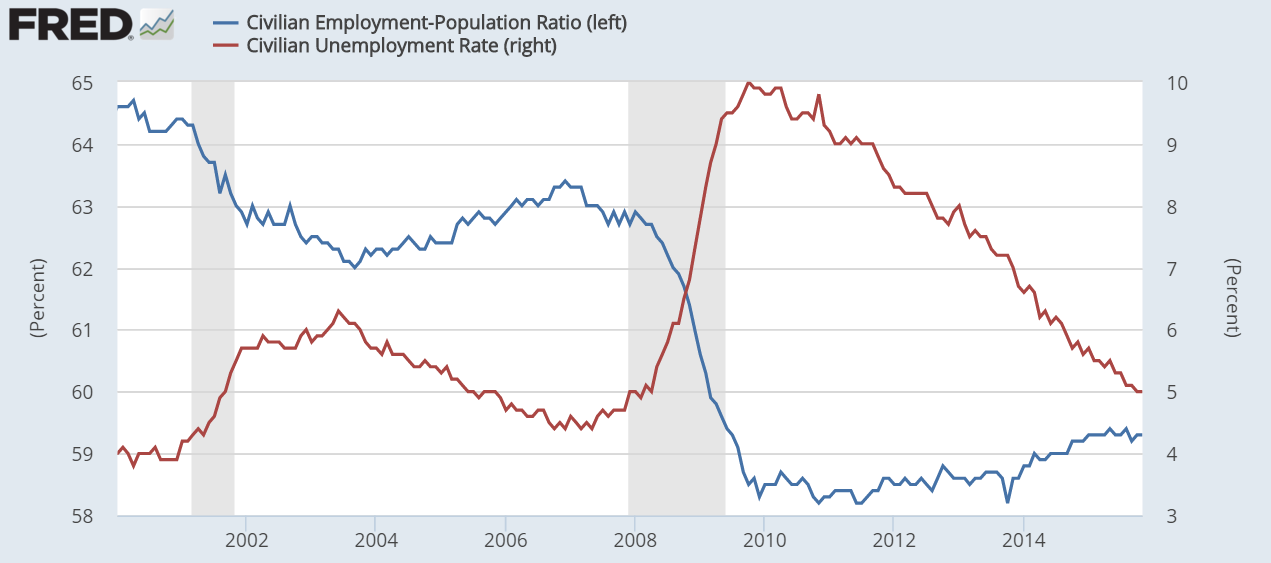

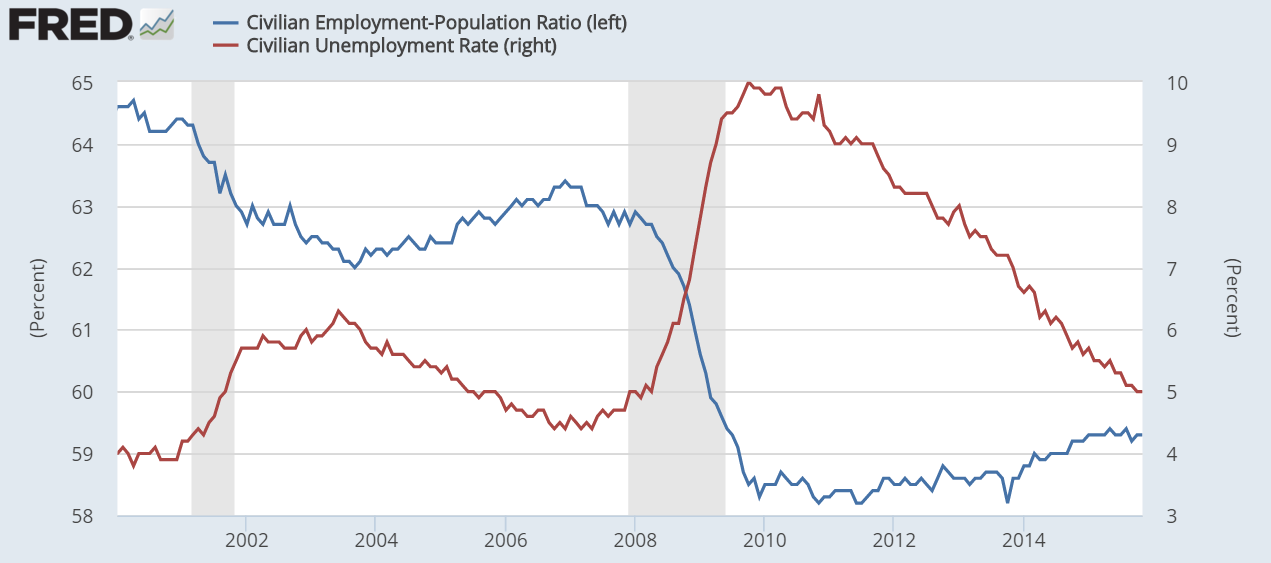

But your unemployment rate is only* 4.1%! The glorious Trump times are here!!

* Does not include anybody who has been looking for a job for more than 6 months.

* Does not include anybody who has given up.

* Does not include full time students who are re-skilling at their own expense.

* Does not include part time workers who would prefer full time employment.

* Does not include high skilled workers who settled for low paying, low skilled jobs.

* Does not include workers who accepted a voluntary early retirement settlement in lieu of layoff.

2017-04-30, 8:39 PM #1666

Reverend Jones

Registered User

Posts: 9,096

I guess that explains the funny business on the right side of this graph then.

2017-04-30, 8:56 PM #1667

Reid

^^vv<><>BASTART

Posts: 9,114

Originally posted by Jon`C:

But your unemployment rate is only* 4.1%! The glorious Trump times are here!!

* Does not include anybody who has been looking for a job for more than 6 months.

* Does not include anybody who has given up.

* Does not include full time students who are re-skilling at their own expense.

* Does not include part time workers who would prefer full time employment.

* Does not include high skilled workers who settled for low paying, low skilled jobs.

* Does not include workers who accepted a voluntary early retirement settlement in lieu of layoff.

* Does not include anybody who has been looking for a job for more than 6 months.

* Does not include anybody who has given up.

* Does not include full time students who are re-skilling at their own expense.

* Does not include part time workers who would prefer full time employment.

* Does not include high skilled workers who settled for low paying, low skilled jobs.

* Does not include workers who accepted a voluntary early retirement settlement in lieu of layoff.

*Does not include professional Fentanyl abusers

2017-04-30, 8:58 PM #1668

Reid

^^vv<><>BASTART

Posts: 9,114

Or maybe that's already one of your categories, or maybe two.

2017-04-30, 9:08 PM #1669

Reverend Jones

Registered User

Posts: 9,096

That's why I thought it might make sense to look at un-unemplyment ~ employment, and sure enough the inverse correlation breaks down post 2011.

The real question now is whether "professional" drug abuse is professional enough to make the government charts.

The real question now is whether "professional" drug abuse is professional enough to make the government charts.

2017-04-30, 9:16 PM #1670

Reverend Jones

Registered User

Posts: 9,096

Another category not included in the government unemployment numbers: people who are dead because they committed suicide.

Who's dark now.

Who's dark now.

2017-04-30, 9:19 PM #1671

Jon`C

Admiral of Awesome

Posts: 18,626

Originally posted by Reverend Jones:

Another category not included in the government unemployment numbers: people who are dead because they committed suicide.

Who's dark now.

Who's dark now.

That's why the blue graph is creeping up.

2017-04-30, 9:20 PM #1672

Reid

^^vv<><>BASTART

Posts: 9,114

Oh, another category that Fentanyl falls under.

2017-04-30, 9:30 PM #1673

Jon`C

Admiral of Awesome

Posts: 18,626

That piss-hitting-a-urinal-cake sound you're hearing is the US economy shrinking. Thank God for finance pulling "wealth" out of thin air, otherwise your government statistics might look quite bad.

2017-04-30, 9:32 PM #1674

Jon`C

Admiral of Awesome

Posts: 18,626

Why yes, selling a factory for scrap metal does count toward GDP. Thank you for asking.

2017-04-30, 9:36 PM #1675

Reid

^^vv<><>BASTART

Posts: 9,114

Remember how Obama was going to bailout the banks, help millions of homeowners and put Americans to work on infrastructure projects?

2017-04-30, 9:37 PM #1676

Jon`C

Admiral of Awesome

Posts: 18,626

One out of three ain't bad I guess

2017-04-30, 11:17 PM #1677

Reid

^^vv<><>BASTART

Posts: 9,114

http://www.news.com.au/technology/online/social/leaked-document-reveals-facebook-conducted-research-to-target-emotionally-vulnerable-and-insecure-youth/news-story/d256f850be6b1c8a21aec6e32dae16fd

It's as if Silicon Valley and Wall Street are in a head to head challenge as to who can sell their collective souls to the devil in the worst way possible.

It's as if Silicon Valley and Wall Street are in a head to head challenge as to who can sell their collective souls to the devil in the worst way possible.

2017-04-30, 11:20 PM #1678

Jon`C

Admiral of Awesome

Posts: 18,626

Silicon Valley is Wall Street.

2017-04-30, 11:28 PM #1679

Reid

^^vv<><>BASTART

Posts: 9,114

Originally posted by Jon`C:

Silicon Valley is Wall Street.

How does that work?

2017-04-30, 11:46 PM #1680

Reverend Jones

Registered User

Posts: 9,096

IIRC, according to Jon`C, Silicon Valley is a bank for rich people to dump money (which they don't otherwise know what to do with) into startups.

According to Paul Graham, Silicon Valley = rich people + nerds.

According to Paul Graham, Silicon Valley = rich people + nerds.